A Biased View of Bank Account

Wiki Article

Some Ideas on Bank Certificate You Should Know

Table of ContentsBank Code Fundamentals Explained10 Simple Techniques For Bank ReconciliationThe Definitive Guide for Bank CertificateSome Ideas on Bank Reconciliation You Need To Know

You can likewise save your cash as well as earn interest on your investment. The cash kept in a lot of savings account is government insured by the Federal Deposit Insurance Coverage Company (FDIC), as much as a limit of $250,000 for specific depositors as well as $500,000 for jointly held down payments. Banks also give credit report chances for individuals as well as companies.

Financial institutions make a revenue by charging more interest to consumers than they pay on interest-bearing accounts. A bank's dimension is identified by where it lies and also who it servesfrom tiny, community-based organizations to large industrial financial institutions. According to the FDIC, there were just over 4,200 FDIC-insured business banks in the USA as of 2021.

Benefit, passion rates, and charges are some of the variables that help consumers choose their liked financial institutions.

The Ultimate Guide To Bank Account Number

financial institutions came under extreme examination after the worldwide monetary crisis of 2008. The regulatory setting for financial institutions has actually considering that tightened considerably therefore. United state banks are controlled at a state or national level. Depending upon the framework, they may be regulated at both degrees. State financial institutions are controlled by a state's department of financial or department of financial establishments.

You must think about whether you intend to maintain both service and individual accounts at the exact same bank, or whether you desire them at separate financial institutions. A retail financial institution, which has basic financial services for consumers, is one of the most appropriate for day-to-day banking. You can choose a traditional financial institution, which has a physical building, or an on the internet financial institution if you do not want or require to physically see a bank branch.

A community financial institution, for instance, takes deposits as well as lends in your area, which might provide a more individualized banking partnership. Choose a hassle-free area if you visit the website are picking a bank with a brick-and-mortar place. If you have a monetary emergency, you do not wish to have to travel a cross country to obtain cash.

The 15-Second Trick For Bank Reconciliation

Some financial institutions likewise provide smartphone applications, which can be beneficial. Inspect the fees related to the accounts you wish to open up. Banks charge interest on car loans as well as monthly upkeep costs, overdraft account charges, as well as wire transfer costs. Some big banks are transferring to finish over-limit fees in 2022, to make sure that might be an important factor to consider.Financing & Development, March 2012, Vol (banking). 49, No. 1 Organizations that pair up savers as well as consumers assist make certain that economic climates operate smoothly YOU'VE obtained $1,000 you do not need for, state, a year and also want to make revenue from the cash up until after that. Or you intend to get a residence and need to obtain $100,000 and also pay it back over 30 years.

That's where financial institutions are available in. Banks do numerous points, their key duty is to why not look here take in fundscalled depositsfrom those with cash, pool them, as well as offer them to those that need funds. Banks are intermediaries between depositors (that offer cash to the financial institution) and also borrowers (to whom the bank provides money).

Deposits can be readily available on need (a monitoring account, for example) or with some limitations (such as cost savings and time deposits). While at any kind of provided moment some depositors need their money, most do not.

The 10-Second Trick For Banking

The procedure entails maturation transformationconverting temporary responsibilities (down payments) to long-term possessions (lendings). Financial institutions pay depositors much less than they receive from debtors, which distinction make up the bulk of banks' revenue in many nations. Financial institutions can complement standard down payments as a resource of financing by straight obtaining in the money and also capital markets.

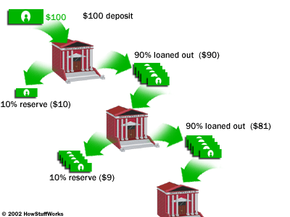

Banks keep those required books on down payment with reserve banks, such as the U.S. Federal Book, the Bank of Japan, and the European Reserve Bank. Banks create money when they lend the remainder of the money depositors provide. This cash can be made use of to purchase products as well as solutions and also can locate its method back into the banking system as a down payment in another bank, which after that can offer a portion of it.

The dimension of the multiplierthe quantity of cash created from an initial depositdepends on the quantity of cash financial institutions must maintain on book (bank account). Financial institutions also lend and also recycle excess money within the monetary system and produce, distribute, and also profession safety and securities. Financial institutions have several means of earning money besides filching the difference (or spread) in between the passion they pay on deposits and also obtained money and also the rate of bank bri interest they collect from borrowers or safeties they hold.

Report this wiki page